A new report published by the Organization for Economic Cooperation and Development (OECD) will allow jurisdictions to opt into the simplified and streamlined approach to qualifying transactions provided by Amount B guidelines, effective January 1, 2025.

The report on Amount B, a Pillar One initiative of the OECD/G20 Inclusive Framework on base erosion and profit shifting (BEPS), known as the Inclusive Framework, was published February 19, 2024.

The report’s goals are to:

- Reduce compliance burden for taxpayers pricing qualifying arrangements

- Prevent and efficiently resolve transfer pricing disputes, thereby improving tax certainty

- Alleviate administrative burden for tax administrations and taxpayers

Who Is Affected by OECD Amount B Guidance?

Taxpayers with qualifying controlled transactions—namely intercompany transactions involving distributors that perform baseline marketing and distribution activities in jurisdictions that adopt this simplified approach—may have the option to benefit from the administrative simplification and increased tax certainty provided by Amount B.

However, taxpayers shouldn’t use the approach to justify an arm’s length outcome when filing tax returns in jurisdictions that don’t elect to apply it, as additional steps must be taken to achieve recognition of its position by the relevant jurisdictions.

Also, proper documentation is still required to ensure the correct application of this approach.

The intention is for the Inclusive Framework to include an optional qualitative scoping criterion for identifying distributors performing non-baseline activities, and to reach a consensus on the low-capacity jurisdictions that fall under Amount B by March 31, 2024.

What Changes with OECD Amount B Guidance?

Here’s a breakdown of what’s changed.

Application of the Simplified and Streamlined Approach

The simplified and streamlined approach applies to controlled transactions with economically relevant characteristics, as prescribed in the OECD guidelines, that can be priced reliably using the transactional net margin method, where the distributor, sales agent, or commissionaire is the tested party.

Per the scoping criteria, the tested party’s annual operating expenses mustn’t be lower than 3% or greater than an upper bound of 20–30% of its annual net revenues, as determined by the relevant jurisdiction. Transactions involving intangible goods, services, commodities, or nondistribution activities are out of scope.

The report provides two options for applying this approach, where a jurisdiction may:

- Allow tested parties within its jurisdiction to elect to apply it

- Require its tax administration and tested parties residing within the jurisdiction to use it in a prescriptive manner, if the scoping criteria are met

According to the Amount B guidance, this approach applies to buy-sell marketing and distribution transactions, where the distributor purchases goods from one or more associated enterprises for wholesale distribution to unrelated parties, and sales agency and commissionaire transactions, where the sales agent or commissionaire contributes to the wholesale distribution of goods to unrelated parties by associated enterprises.

Amount B Pricing Framework

Amount B provides a pricing framework consisting of a matrix of returns, also referred to as a pricing matrix, an operating expense cross-check procedure, and a data availability mechanism.

The pricing matrix, developed from a global dataset of companies engaged in baseline marketing and distribution activities, is a tool that companies can use to determine whether their pricing aligns with the arm’s length principle.

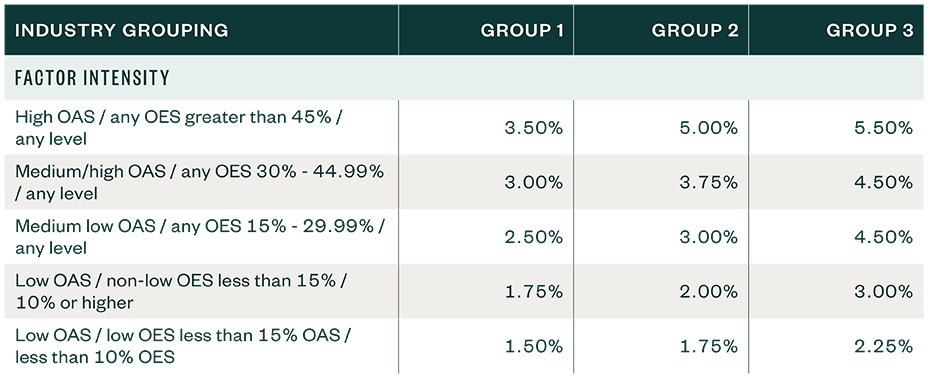

The matrix segments the approximation of arm’s length results into segments based on the following:

- Net operating asset intensity (OAS)

- Operating expense intensity (OES)

- Industry groupings

Industries and sectors are categorized into three groups based on the observed relationships between specific industries, products, and profitability.

Group 1 includes:

- Perishable foods

- Groceries

- Household consumables

- Construction materials

- Plumbing supplies

- Metals

Group 2 includes:

- IT hardware

- Animal feeds

- Pharmaceuticals

- Home appliances

Group 3 includes:

- Medical machinery

- Industrial machinery

- Miscellaneous supplies

The following table is the pricing matrix provided in section five of the Amount B report.

Pricing Matrix (Return on Sales %)

3-Step Process to Calculate the Return

To calculate the return for a tested party engaged in in-scope transactions, the following three-step process must be applied to identify the:

- Relevant industry groupings of the tested party as defined in the guidance

- Relevant factor intensity classification of the tested party and identify the applicable horizontal row of return on sales in the pricing matrix

- Range from the pricing matrix segment that corresponds to the intersection of the industry groupings and the factor intensity classification of the tested party

The return derived from step three produces a range equal to the return on sales percentage derived from the pricing matrix, and any point within that range plus or minus 0.5% can be relied on for demonstrating compliance with the guidance articulated in the Amount B report.

Cross-Checking for Primary Return on Sales

The operating expense cross-check involves a four-step process to ensure that the primary return on sales net profit indicator is applied within a predefined operating expense cap-and-collar range for all in-scope transactions.

The data availability mechanism is intended to address situations where there’s inadequate or no data available in the global dataset for a particular tested party in a qualifying jurisdiction. The return of a tested party in a qualifying jurisdiction will be adjusted using a formula outlined in the Amount B guidance that considers their return on sales percentage and net operating asset intensity percentage, as well as the net risk adjustment of the qualifying jurisdiction.

Timing Considerations

Jurisdictions within scope of the Amount B guidelines will have the option to implement a simplified and streamlined approach to qualifying transactions, effective January 1, 2025.

Next Steps with OECD Amount B Guidance

- Await release of the Inclusive Framework’s list of low-capacity jurisdictions that fall under Amount B, expected by March 31, 2024

- Determine if you have controlled transactions that would qualify for the simplified and streamlined approach provided by the Amount B report

- Maintain proper documentation, while adhering to the Amount B guidance, that establishes your eligibility for and proper application of this approach

We’re Here to Help

If you have questions on how Amount B guidance could affect your transactions, please contact your Moss Adams professional.